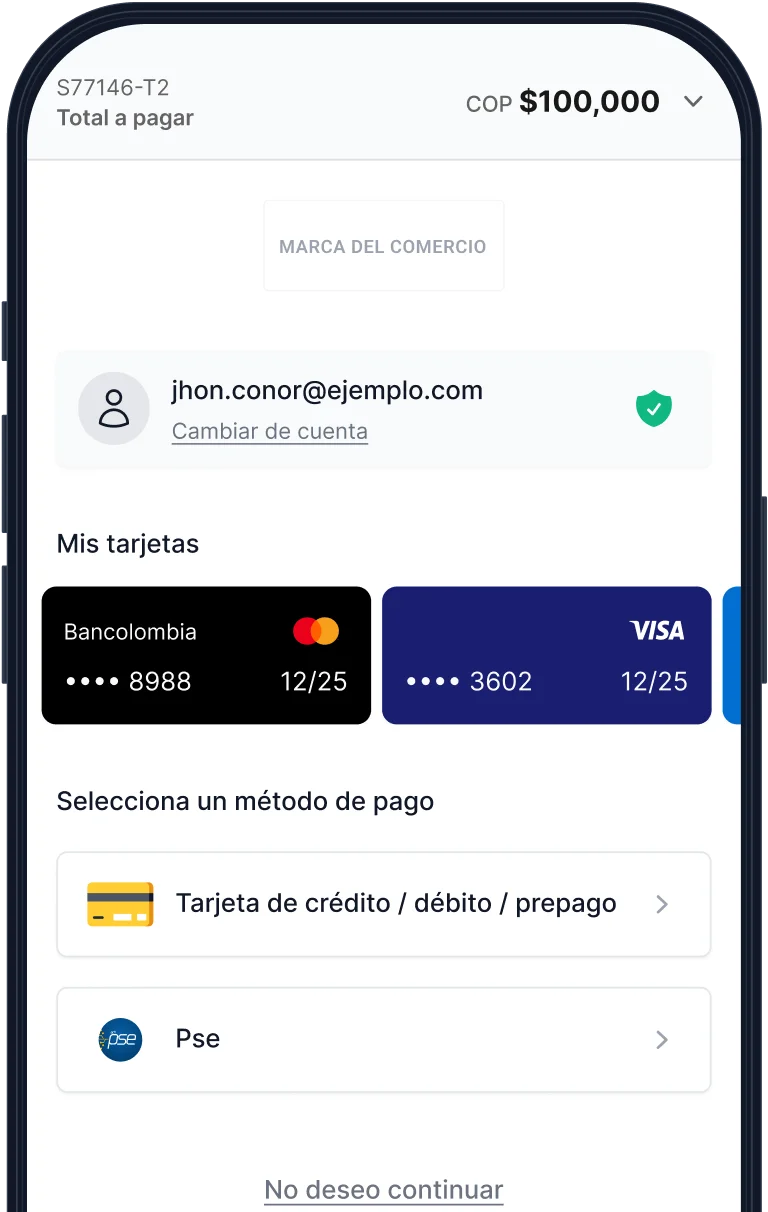

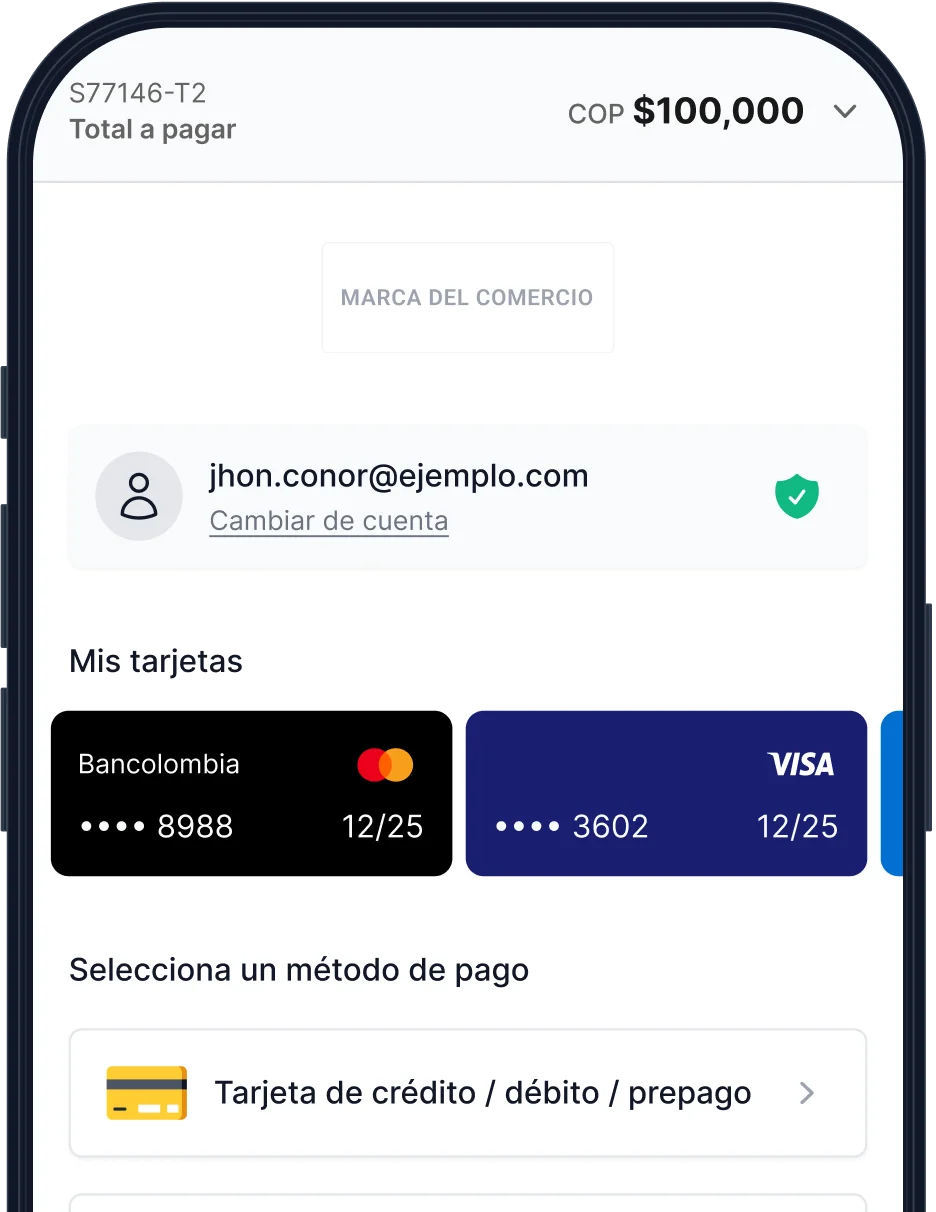

1. Payment Method Selection

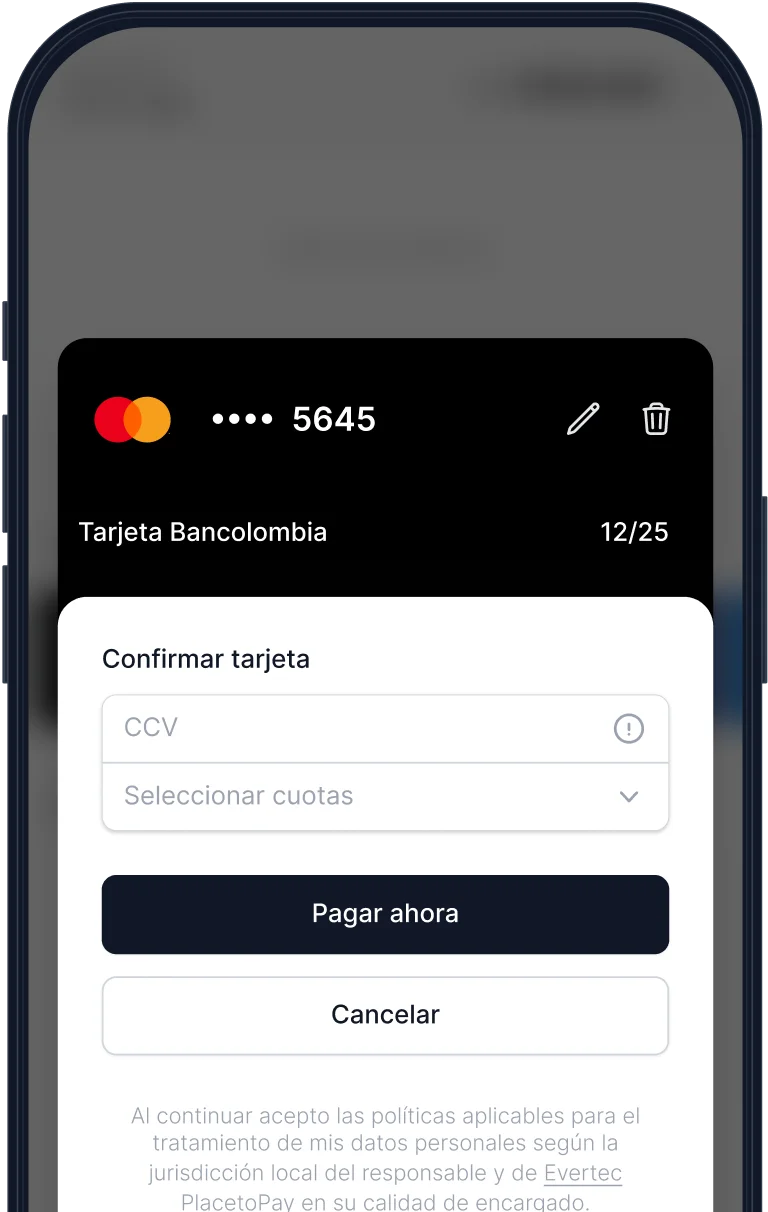

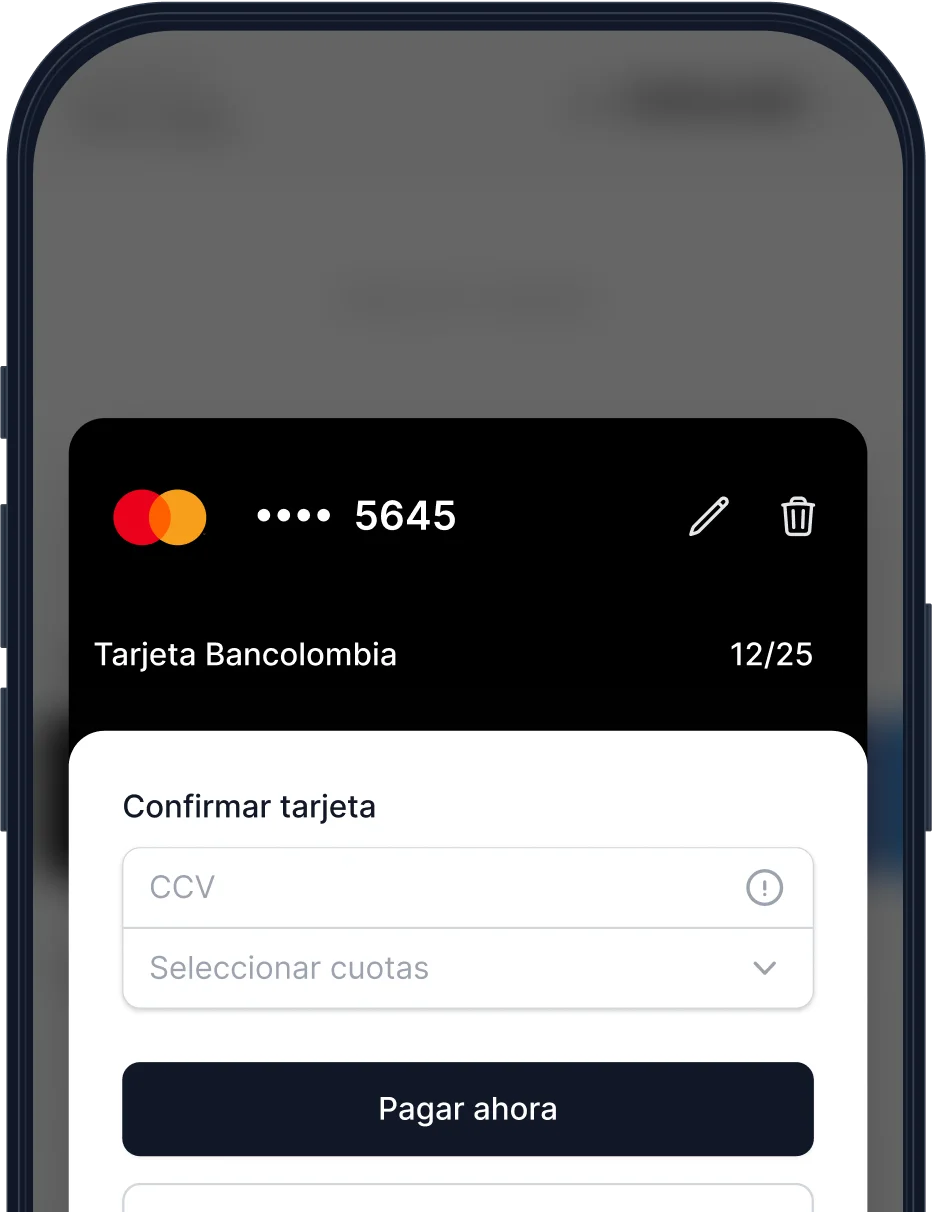

2. Enter Payment Data

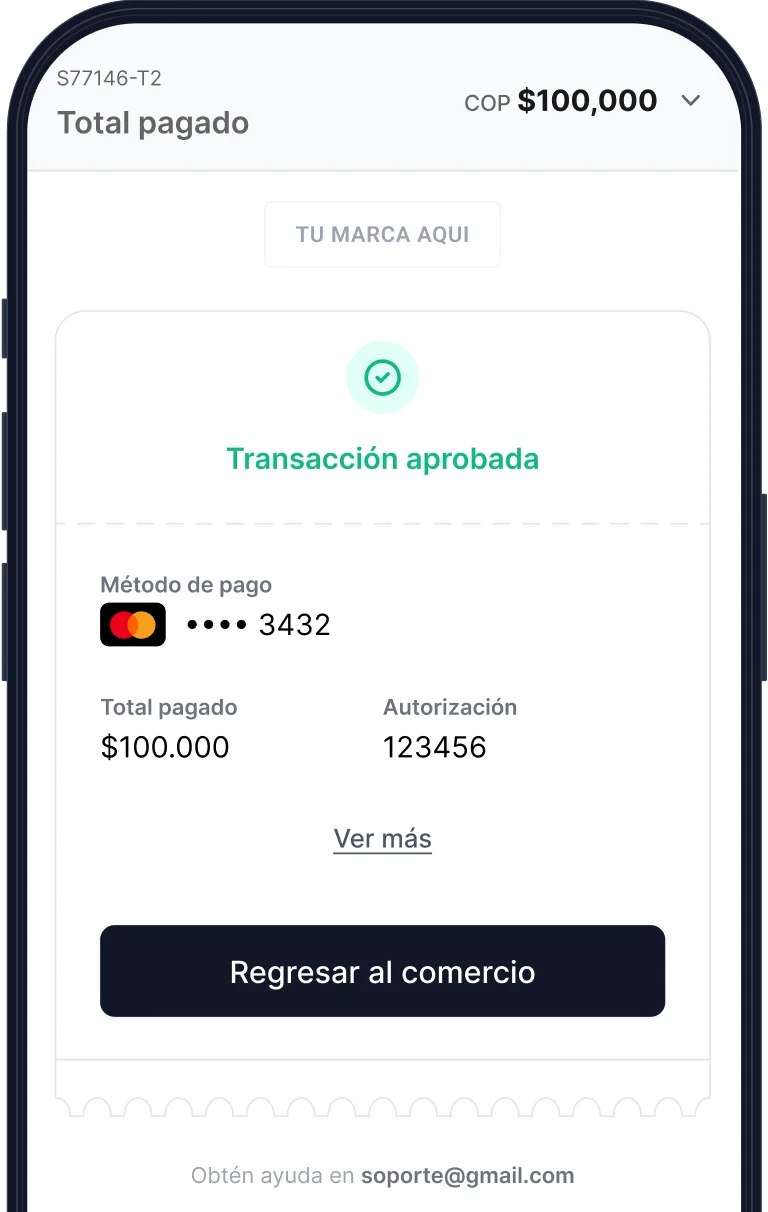

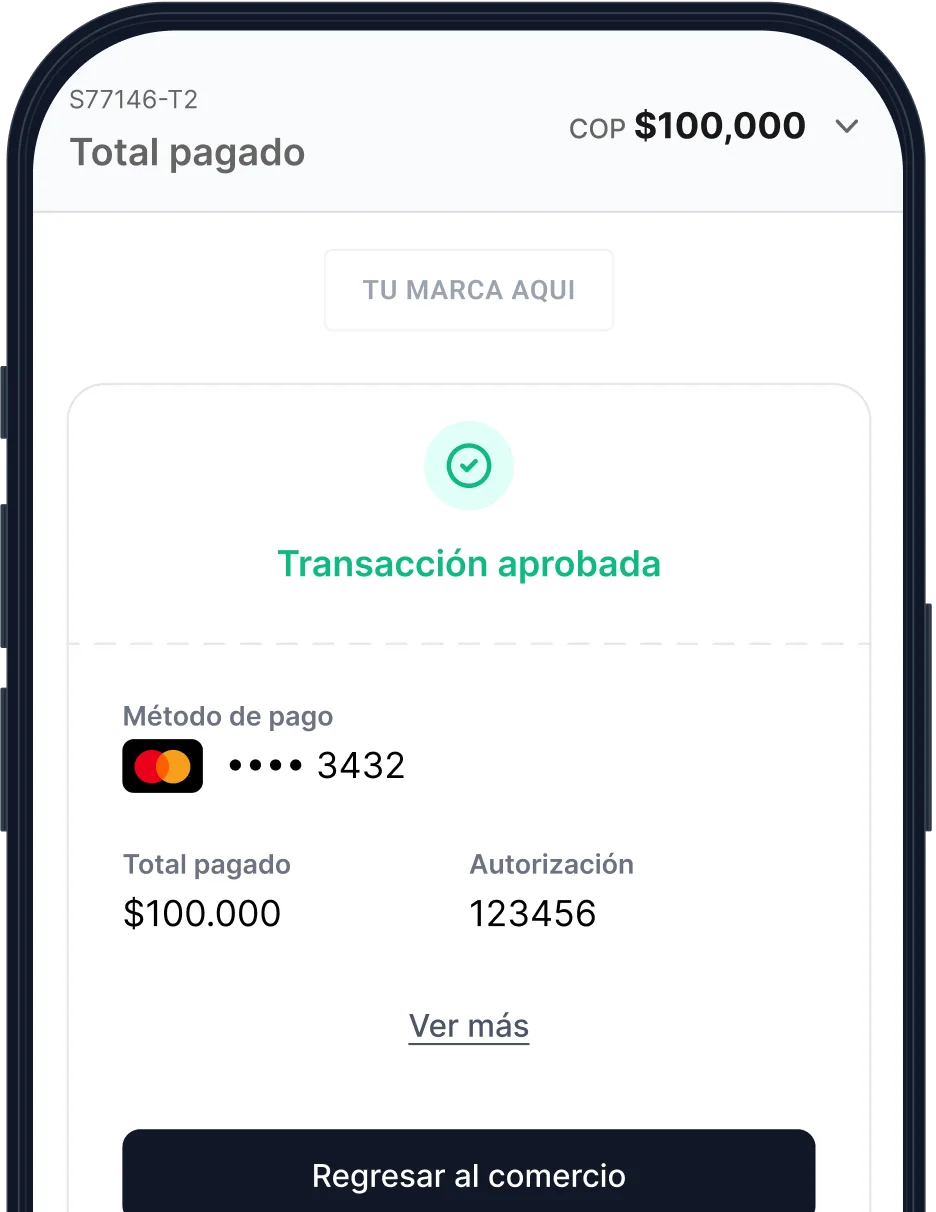

3. Result of the transaction

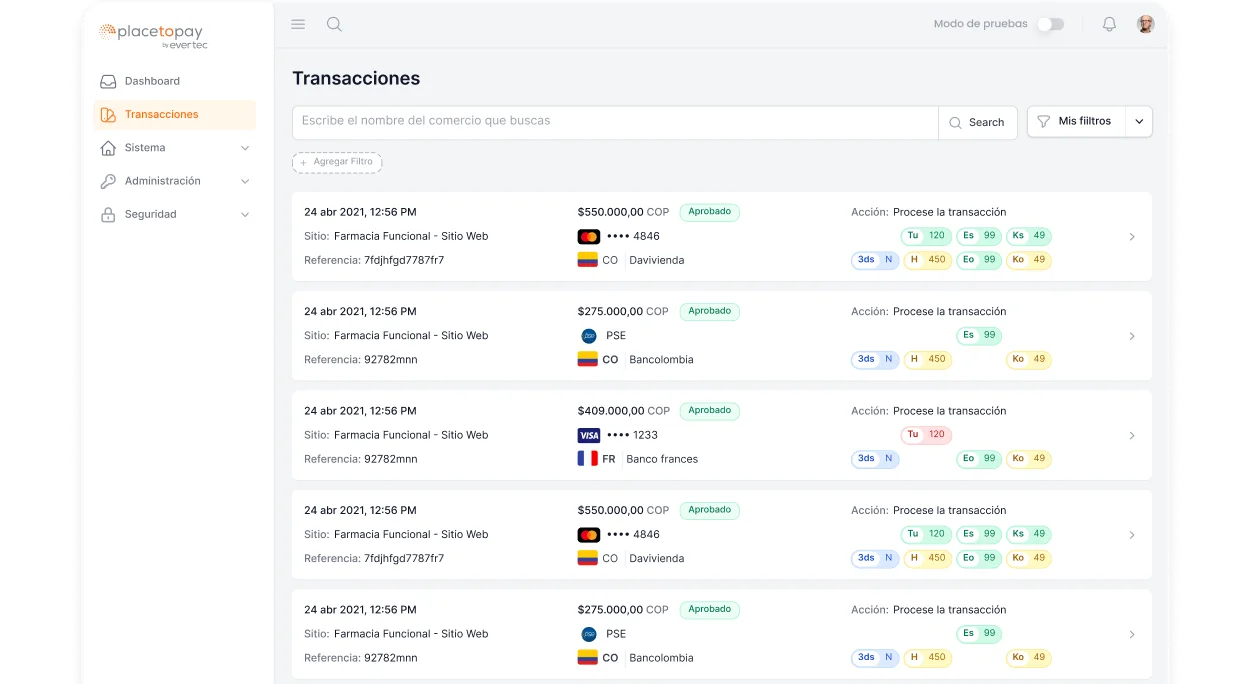

Prevent fraud and increase the security of your online payments without negatively affecting the conversion rate or your customers' purchasing experience.

Discover how EMV 3DS can change the way you run your business!

Our certifications

Implementing an additional authentication process can help you differentiate a legitimate customer from a scammer and thus obtain

Thanks to the Identification of low risk transactions, we authenticate most transactions transparently

Rich data and flexible authentication methods help improve the decision-making process for issuers to determine the legitimacy of a transaction.

Your customers can use their preferred devices to shop online and expect faster and easier authentication. Fewer declined purchases and greater confidence in the security of the transaction.

There are two different ways in which customers can authenticate using 3DS:

Frictionless flow is based on prior information that does not require active customer verification

How does Placetopay contribute to transaction security?