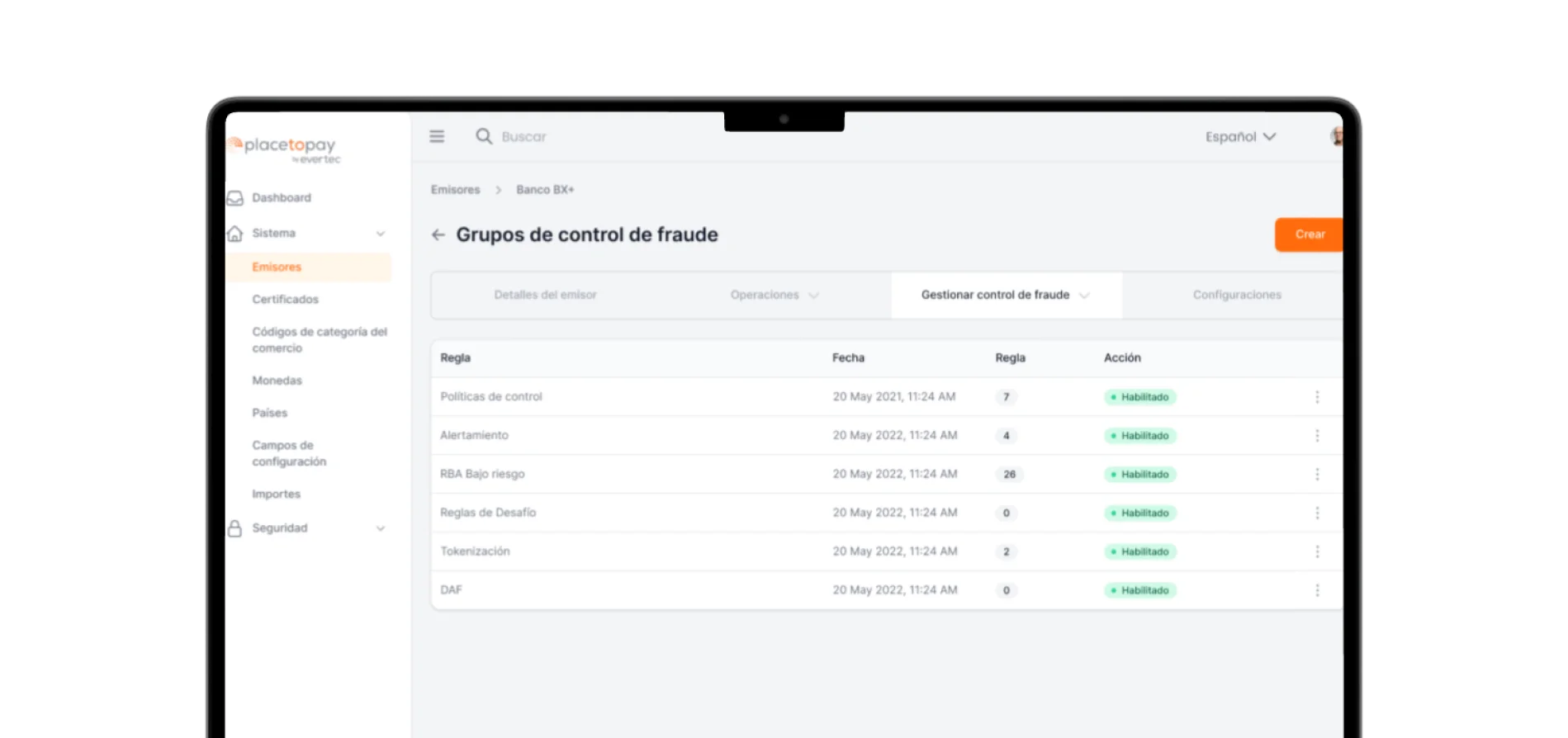

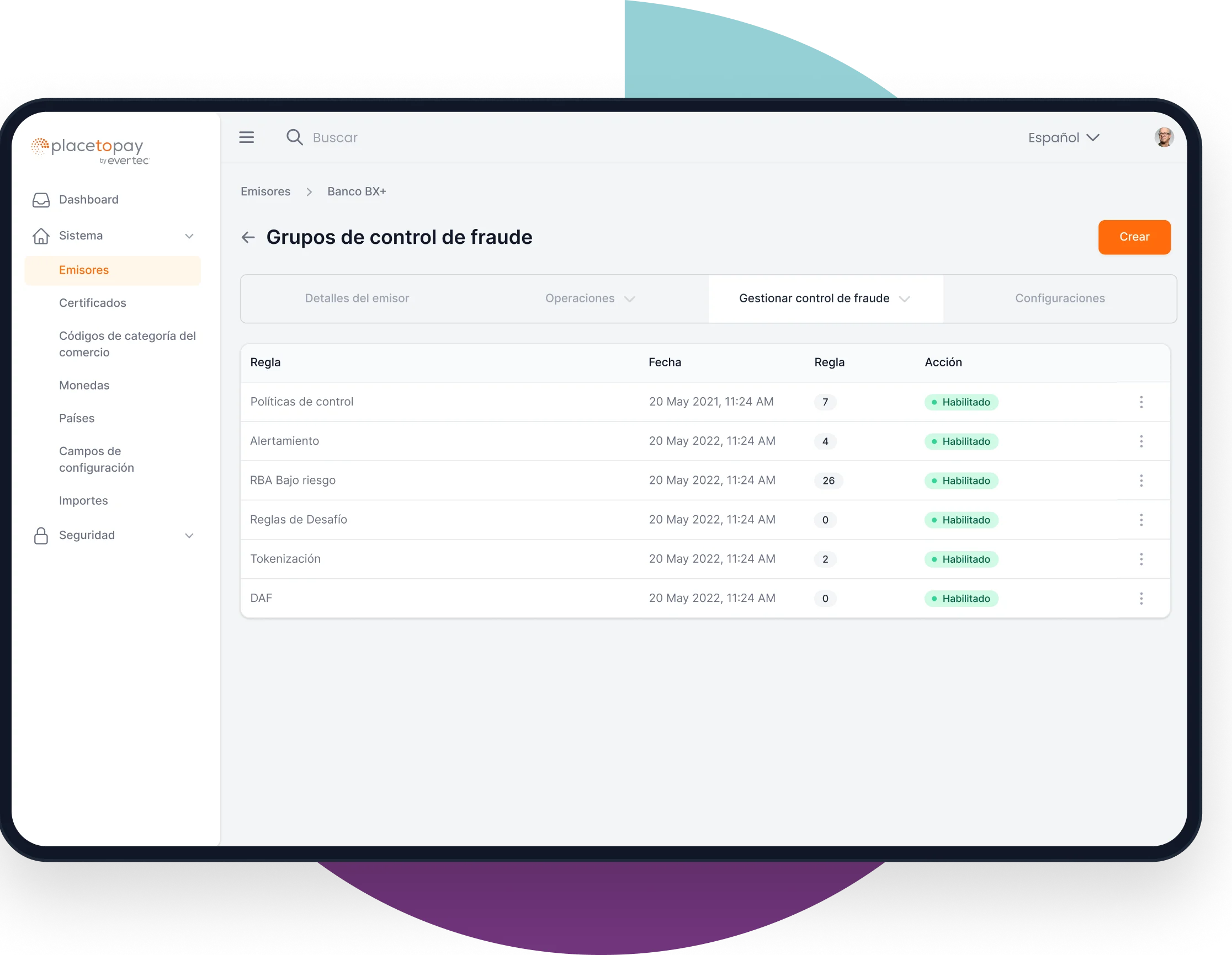

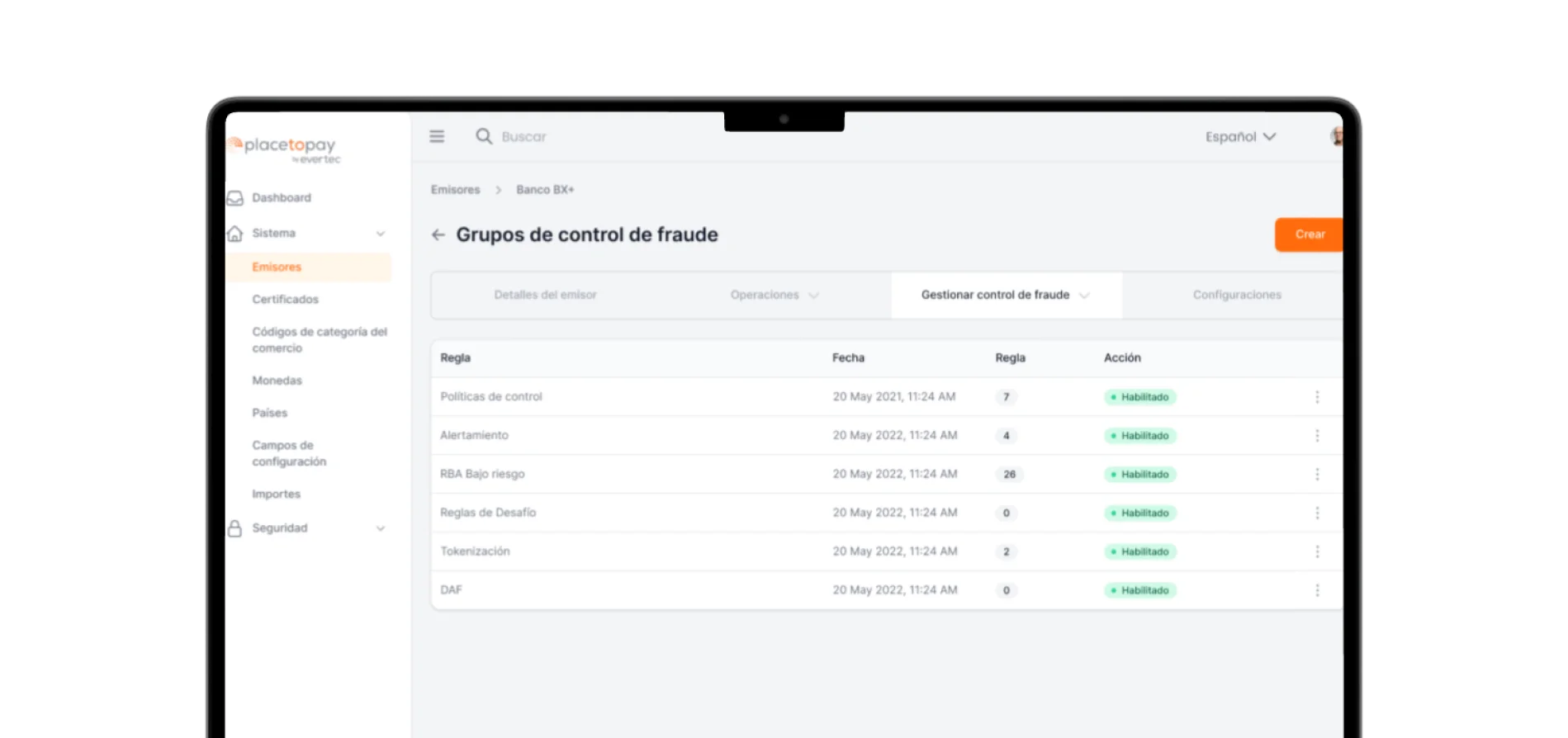

RBA

Risk Based Authentication, customizable rules engine, which manages business rules configured by the issuer.

Increase your users' trust by offering safer online transactions by controlling frictionless and frictionless flows. With EMV 3DS, you'll be one step ahead in fraud protection and meet the most rigorous industry standards.

Promote your brand as a trusted issuer and increase the satisfaction of your customers.

Discover how EMV 3DS can take you as an issuer to the next level!

Benefits of frictionless integration

Authentication experiences designed to reduce friction

We provide fraud monitoring and prevention tools and protocols, so that our clients can offer a better experience to cardholders, increasing payment security without generating friction for their clients.

Risk Based Authentication, customizable rules engine, which manages business rules configured by the issuer.

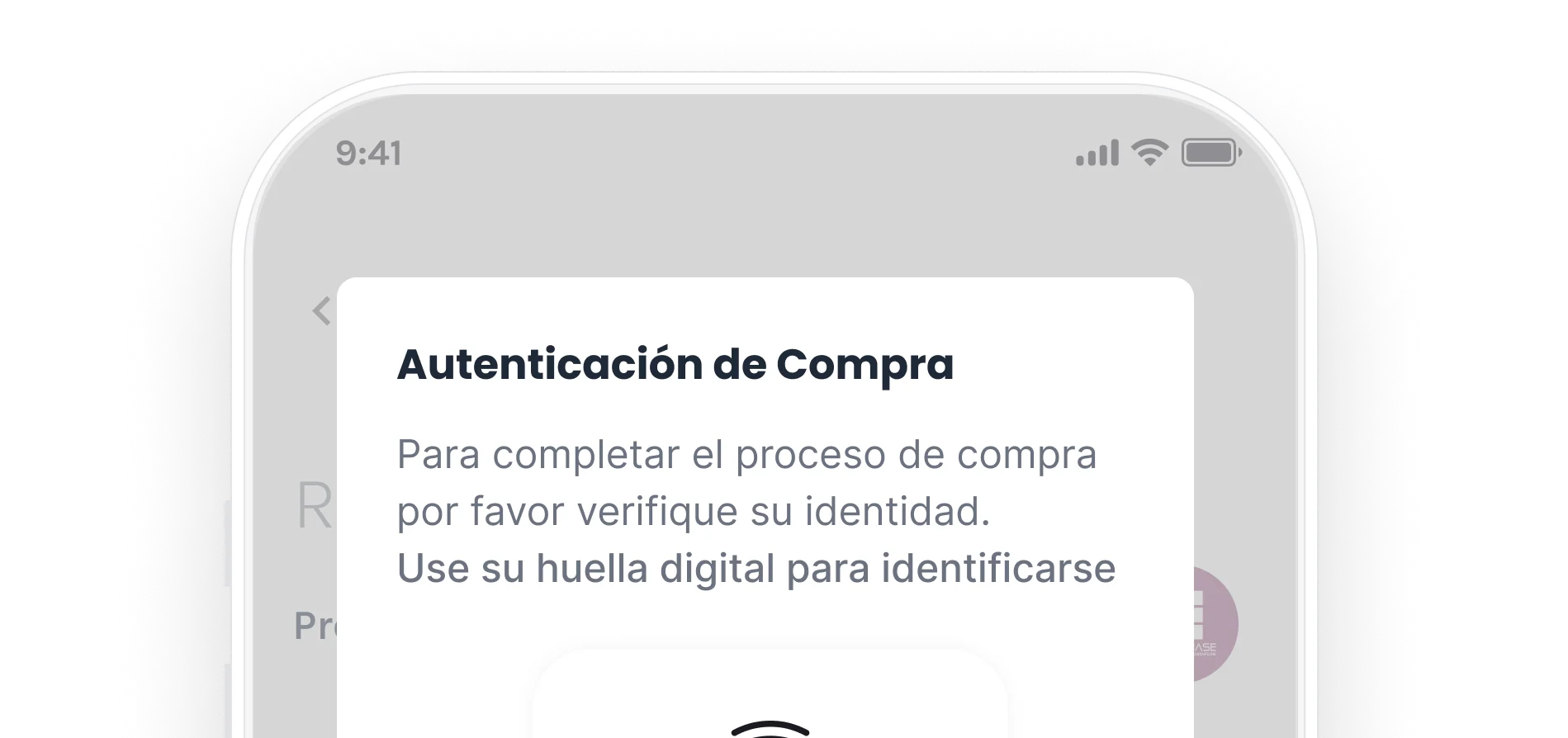

Notifications to the client's mobile phone, where an action for authentication is requested

The issuer is responsible for authenticating a transaction

Unique, time-limited key sent via text message or email to validate transactions.

A strategic decision for the security of online sales

Given the evolution of electronic commerce and the rise of new technologies, as well as new forms of fraud, at Evertec we reaffirm our commitment to being “the technology of the possible.”

Optimized payment flows for a frictionless shopping experience

by false positives, by not depending on external fraud control systems.

fraud control and monitoring with our administrative console.

Generating greater income

If they try to be impersonated or generate alerts, they will go through a 2FA authentication process