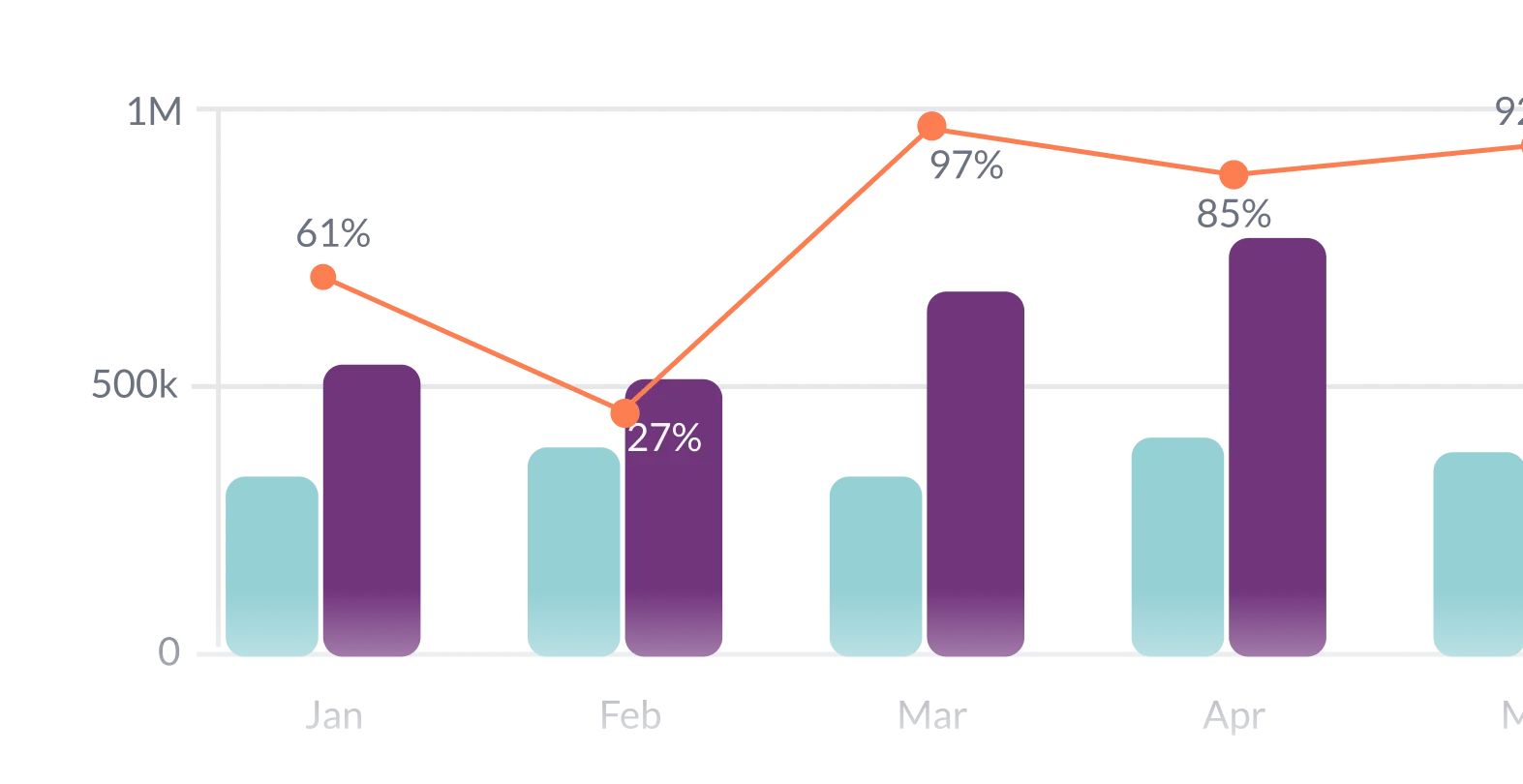

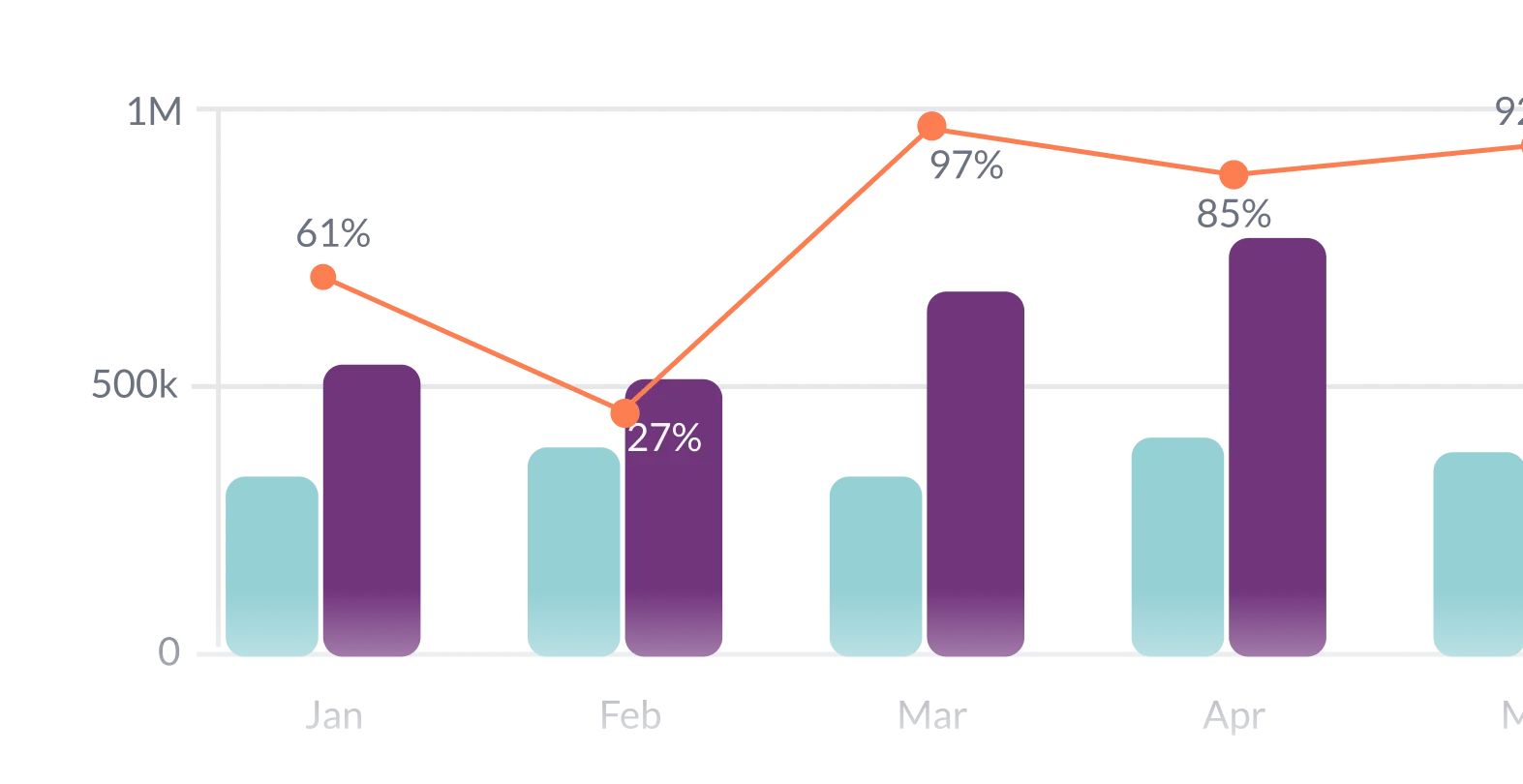

Pass Rate

By regularly measuring your business's approval rate, you can validate the impact of the decisions you make regarding the security of your users' transactions and shopping experience.

You will be able to quickly check your approval, decline and failure rate, as well as the reasons for failure. And create improvement strategies based on the transactional behavior of your business and the industry.

If you are already integrated with our payment solutions, contact us and receive our report in your email

New businesses will have their first report Free

And they will receive close monitoring with us.

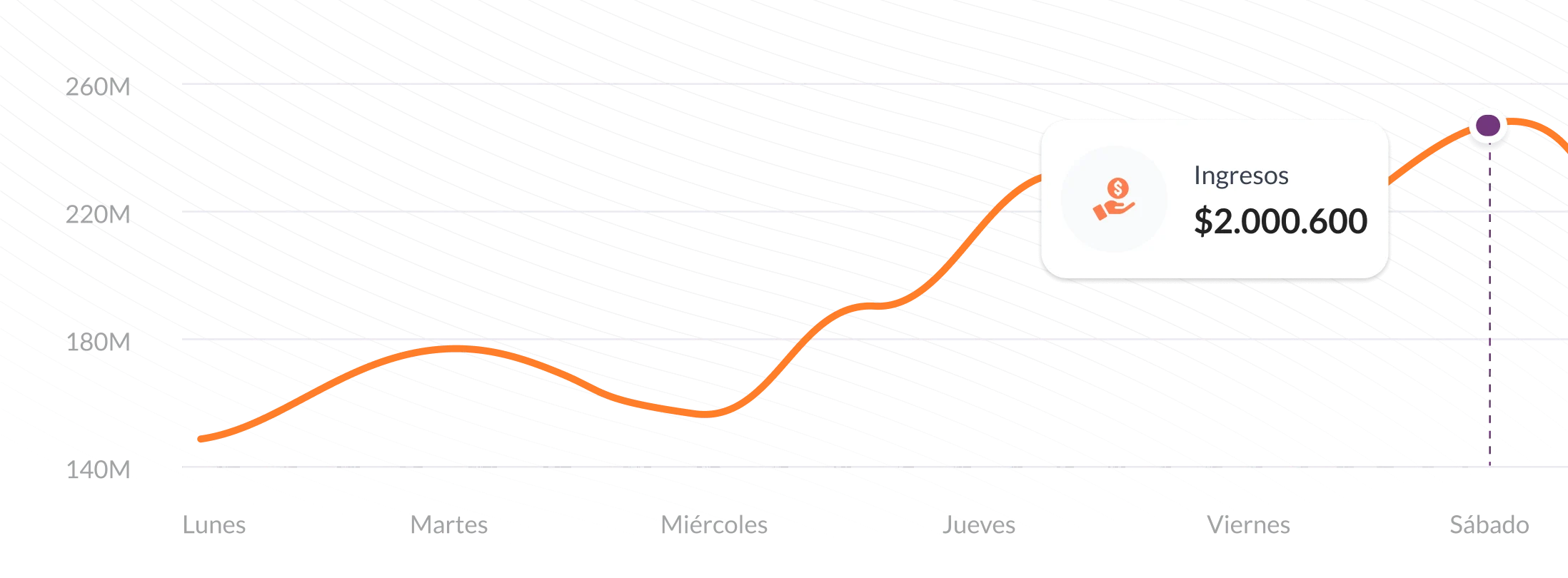

Analysis of Transactional Movements

By regularly measuring your business's approval rate, you can validate the impact of the decisions you make regarding the security of your users' transactions and shopping experience.

For all companies, the goal is for customers to complete their purchase successfully on the first try and not have to worry about their payment. When authentication rates are low, more consumers will see their transactions decrease.

Understanding customer churn is essential to evaluating the effectiveness of your marketing efforts and the overall satisfaction of your customers. It's also easier and cheaper to keep existing customers rather than acquiring new ones.

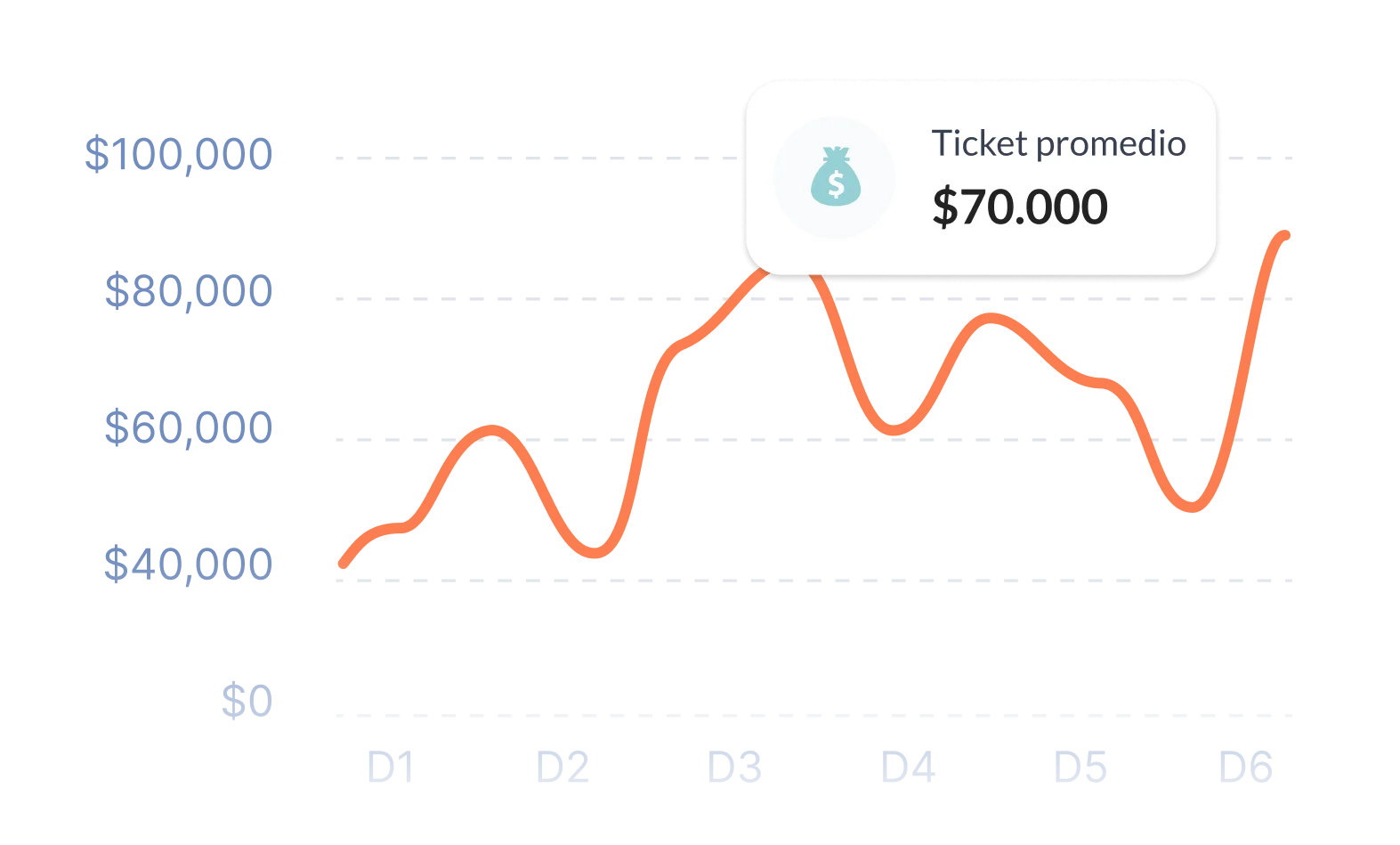

Make strategic decisions based on the segmentation of your clients' spending. You will be able to set prices, design sales and marketing strategies to increase your profitability

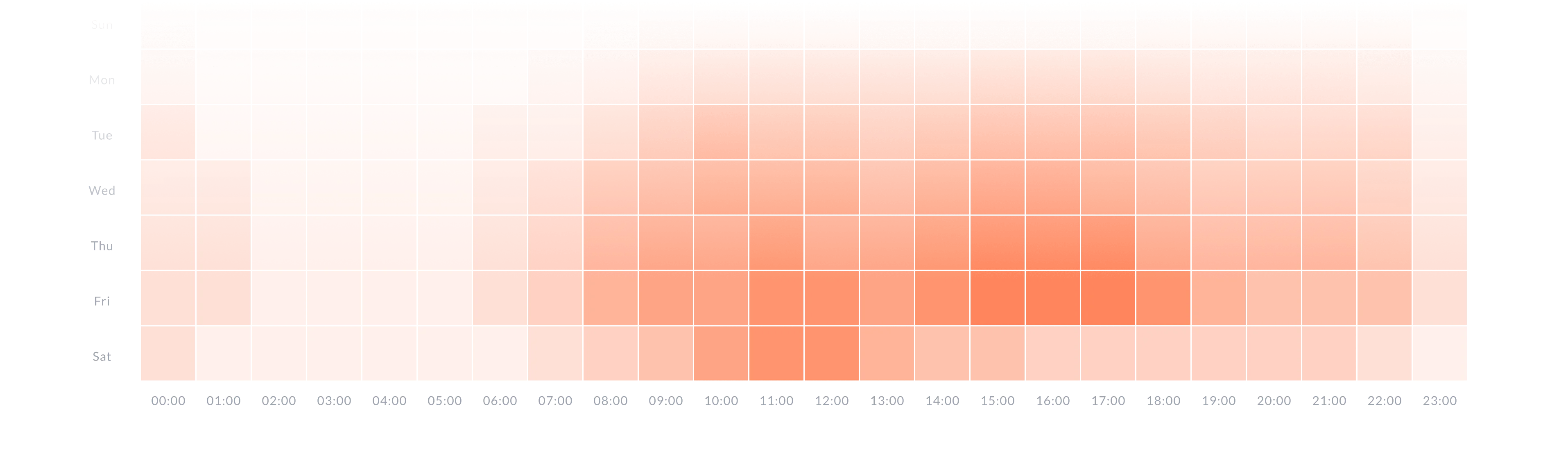

Table of days and hours of high and/or low transactional activity of your clients, to identify days and times in which you can create strategies such as offers

Be aware of the reasons for the decline in your business transactions. And make adjustments based on the behavior of your users

Create alliances with the payment methods that your users use the most. This way you will attract new customers and retain current ones.

You will obtain greater efficiency in response times, by reducing the operational burden involved in manually verifying each transaction.